Here you can find information about...

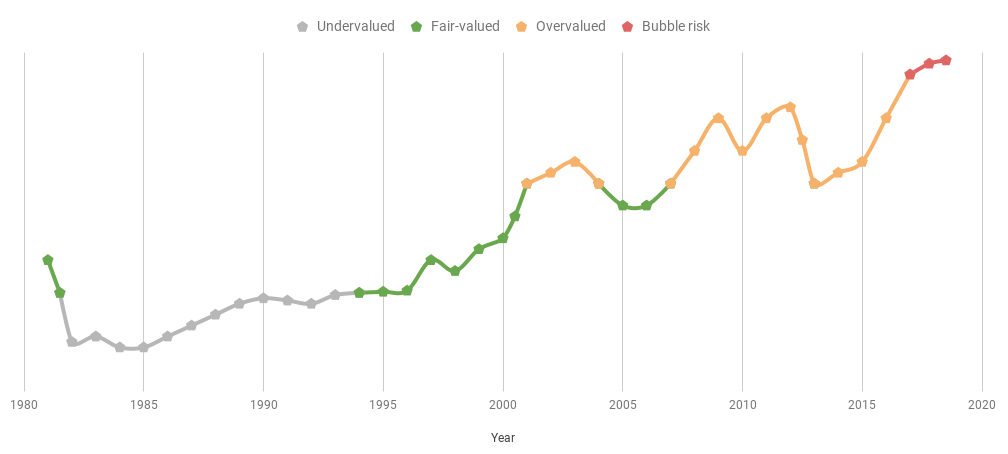

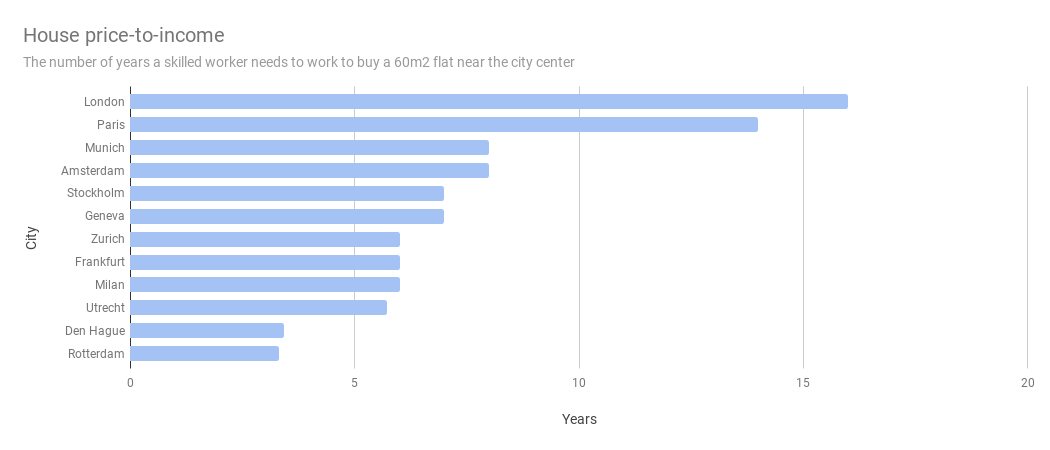

Is it good time to buy a house in the Netherlands.

How much money you can make on Airbnb.

Compare in details house rent vs owning a house in the Netherlands.

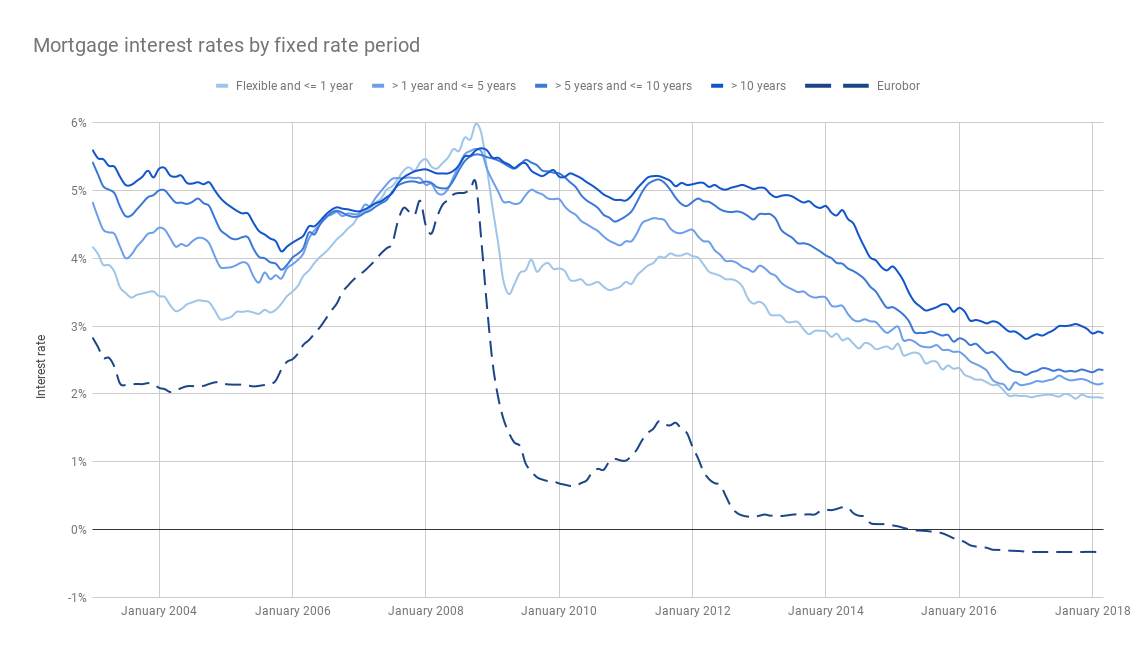

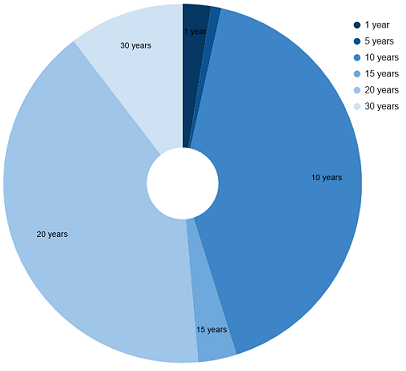

How to invest in property in the Netherlands. Mortgage requirements, taxation, restrictions, expected returns.

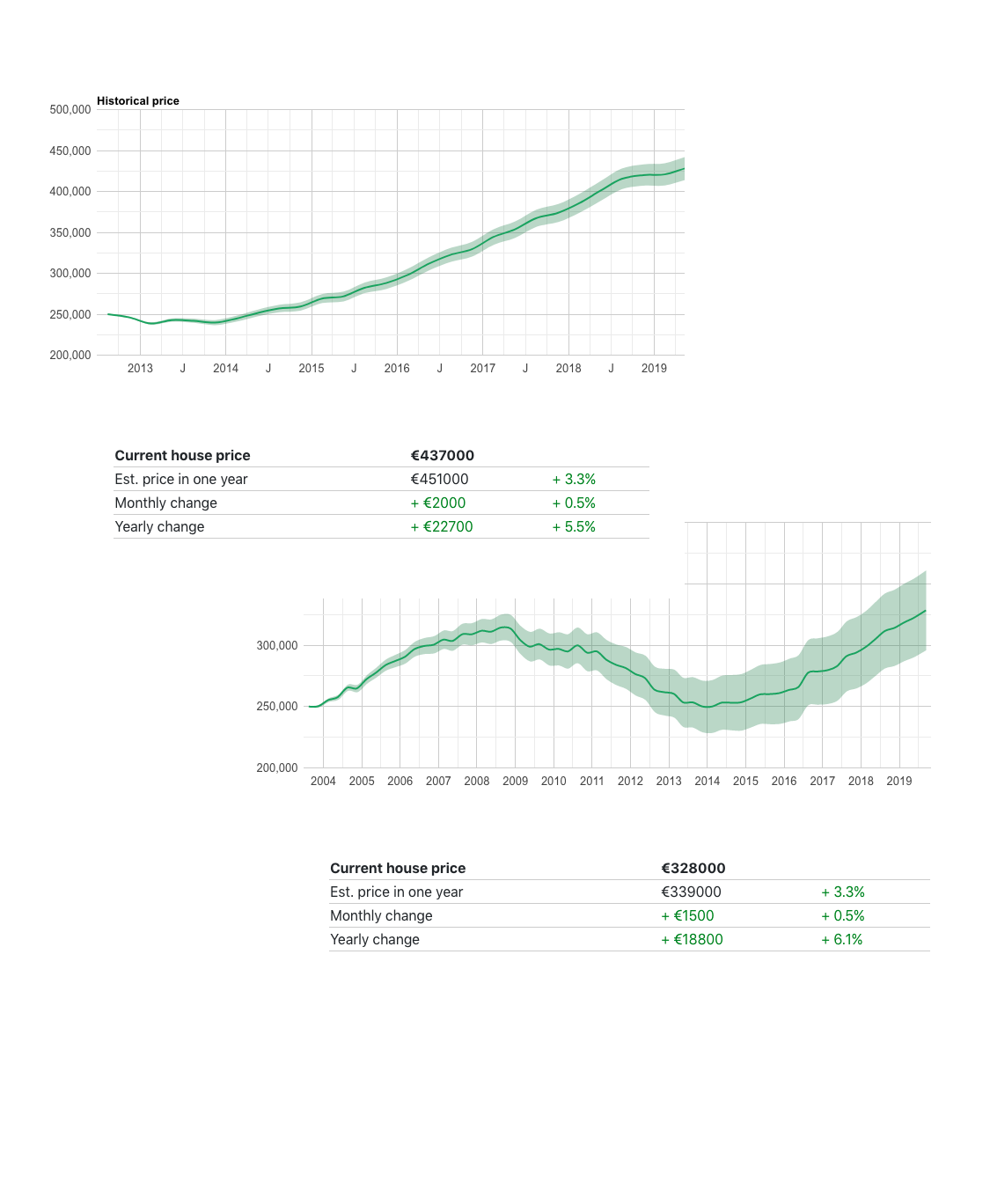

Calculate the current price of your house and get price forecast for next year.

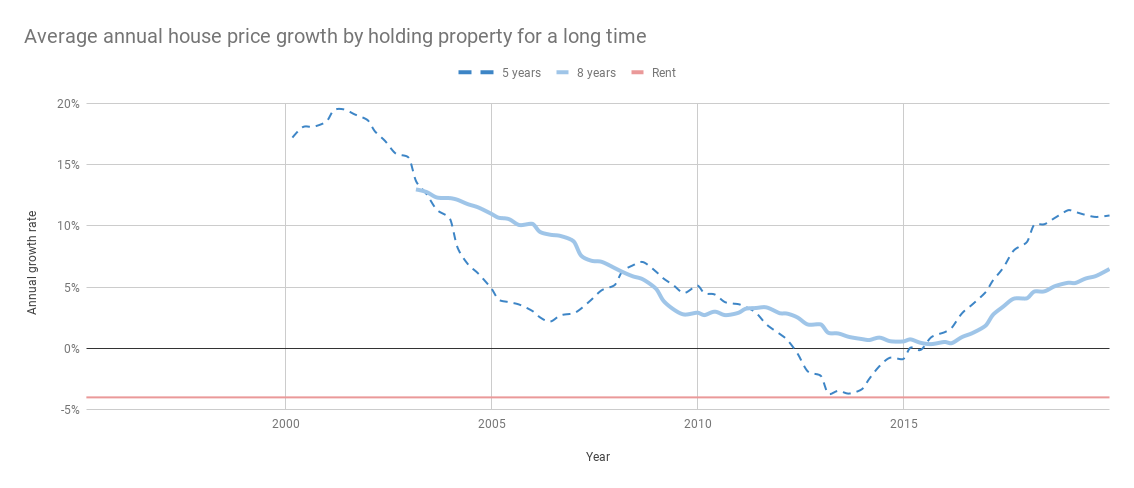

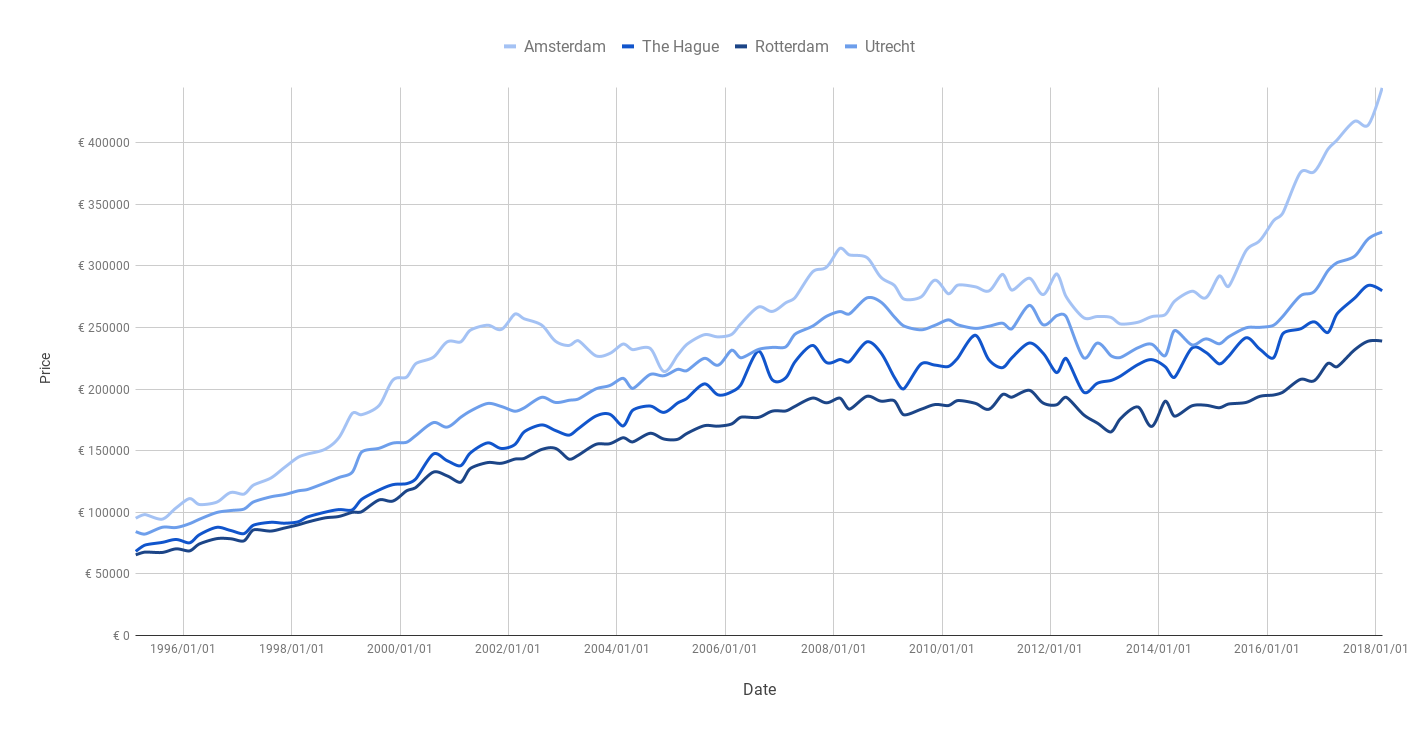

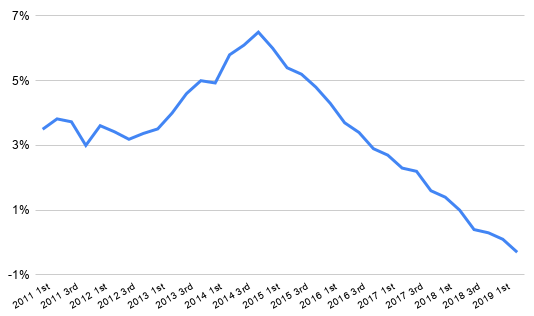

Dutch house price trends

Dutch house price trends

.png)

.png)

.png)

.png)